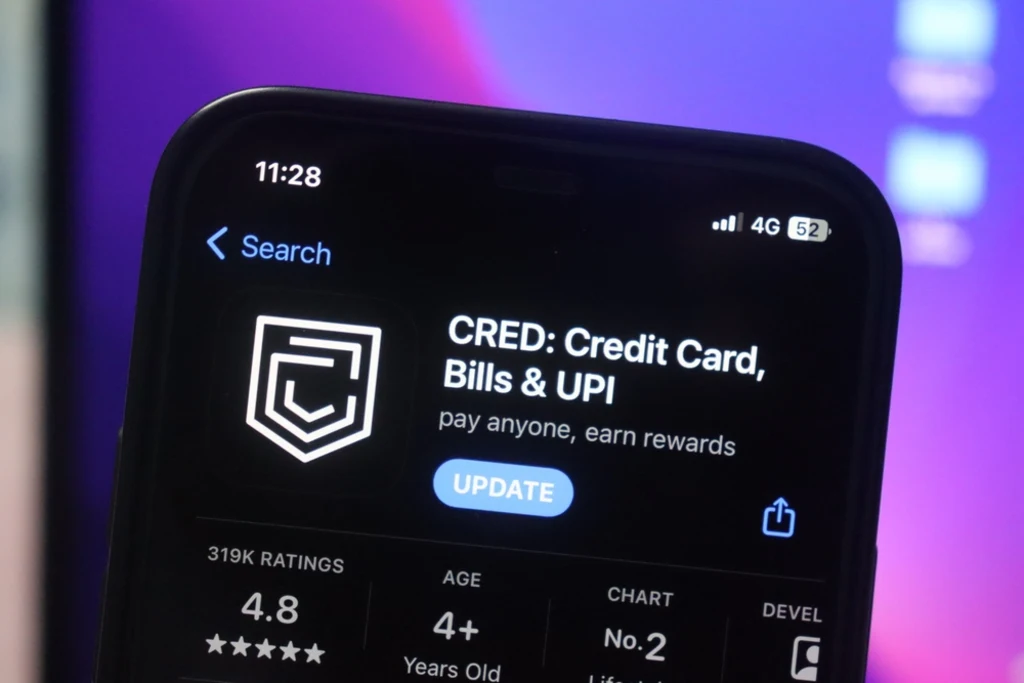

With the development of robo-advisors, the financial technology (fintech) segment has experienced noteworthy changes over a long time. These mechanized, algorithm-driven stages have totally changed how individuals oversee their accounts and businesses, from making people digitally educated and using payment online app to so much more. This article looks at the effect of robo-advisors on the fintech scene, pushing their notable highlights, preferences, and downsides.

The Rise of Robo-Advisors

Robo-advisors have picked up critical footing over a long time, revolutionizing the way people oversee their funds. Additionally, robo-advisors work 24/7, empowering clients to screen their speculations in real time and make educated choices in their comfort. They also facilitate the process of bill payment and other utilities and makes the consumer pay fees in no time.

This level of comfort and straightforwardness has made them progressively well-known among both amateur financial specialists and experienced budgetary devotees alike. UPI has played a significant role in facilitating this accessibility by providing seamless transactions and enabling easy access to investment opportunities

As these stages proceed to advance, they are anticipated to play a pivotal role in reshaping the long-run scene of money-related admonitory administrations, making modern venture methodologies available to everybody, in any case of their monetary ability. With the integration of convenient payment methods like the UPI app, financial transactions and investments can be more accessible and seamless for a wider range of individuals.

Key Features of Robo-Advisors

Robo-advisors offer several key features that make them attractive to both novice and experienced investors. They provide personalized investment strategies based on individual financial goals, risk tolerance, and time horizon. The automated nature of these platforms ensures efficient portfolio rebalancing and tax optimization, maximizing returns for investors. Moreover, robo-advisors streamline the process of payment online, making it convenient for users to fund their accounts and manage their investments seamlessly.

Benefits of Robo-Advisors

Traditional financial advisors typically charge higher fees, making personalized investment advice inaccessible to many. Robo-advisors, on the other hand, offer competitive fees and transparent pricing structures, democratizing wealth management services. Moreover, these platforms provide 24/7 access to investment accounts, allowing users to monitor their portfolios and make informed decisions at any time. Additionally, some robo-advisors facilitate seamless transactions through payment UPI, enhancing the user experience further.

Challenges and Considerations

While robo-advisors offer numerous advantages, there are challenges and considerations associated with their usage. One significant concern is the reliance on algorithms and historical data, which might not account for unforeseen market events or economic crises. Consequently, users must be aware of the limitations and carefully consider the recommendations made by these platforms.

Conclusion:

Robo-advisors have undeniably changed the fintech landscape, democratizing access to sophisticated investment strategies and financial planning. With their low fees, convenience, and automated portfolio management, these platforms have empowered individuals to take control of their financial futures. Some platforms may require users to pay fee for additional premium features or services, but the overall cost remains significantly lower than traditional financial advisory services.