Mutual funds are one of the most accessible investment options for beginners. They offer diversity and long-term financial growth. If you are new to mutual funds, this guide will help you understand the basics of it and help you along your journey of investments-

Why Invest in Mutual Funds?

Mutual funds are a simple method to increase your wealth while reducing risks by diversification. Your goal might be to create long-term savings or to just meet short-term financial goals. A suitable mutual fund can help you with any of your goals. There are a number of good names in the industry, like HDFC mutual fund, which offer good schemes from equity to hybrid and debt funds.

How to Select the Appropriate Mutual Fund?

The most important decision is to select a good mutual fund to invest in. It depends on your investment goals, risk tolerance, and time horizon. Most investors like already established funds like SBI Mutual Fund, which can deliver good returns and are more predictable.

Steps to Start Investing in Mutual Funds

Investing in mutual funds is a well-defined procedure, and the more clear you are, the better decisions you will make. Follow the below steps and make informed choices-

1. Define Your Investment Goals

Before investing, decide if your goal is wealth creation, tax saving, or generating passive income. Apps that support 5paisa Capital transactions make it easier to set financial goals and invest accordingly.

2. Select the Right Type of Mutual Fund

Mutual funds are of various types. For example there are equity funds (high risk, high return), debt funds (low risk, stable return), and hybrid funds (balanced risk and return). Online platforms like mStock and Angel One can give information on the top performing funds in each category.

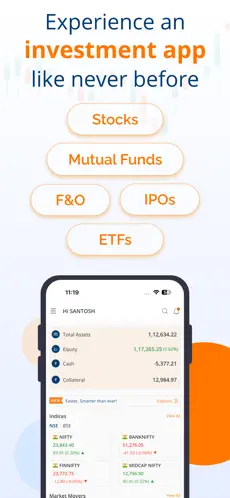

3. Select an Investment Platform

Most financial apps and online platforms offer smooth mutual fund investments. Look for a platform that provides functions like portfolio tracking, easy withdrawals, and research-led advice. Some well-known investment apps include those that support MF investments with a lot of ease.

4. Choose a SIP or Lump Sum Investment

Systematic Investment Plans (SIP) help you invest in small amounts regularly, so it is easier to build wealth over time. If you have a lump sum amount, you can make direct investments. Sites offering ICICI Prudential Mutual Fund and similar schemes facilitate the same.

5. Track and Change Your Investments

Mutual fund investment is not a one-time activity. You need to keep track of your portfolio and adjust accordingly in line with market movements. There are a few apps that support HDFC Mutual Fund investments, and they usually have real-time information to help you make the right decisions.

Conclusion:

Mutual funds are a good investment option, especially for first-time investors who want expert fund management and diversification. With the help of platforms that provide easy access to funds like SBI Mutual Fund, 5paisa Capital, and Angel One, you can begin your investing journey with ease. Mutual funds offer an organized method to become financially successful and, when done wisely, can give you great results over time.