Dealing with sudden financial necessities can be daunting, especially if you don’t have direct access to funds. From a medical crisis to a urgent purchase, having options available to address money shortages are very helpful. That’s why individuals are now opting to apply loan online instead of going through traditional banks. The online process is not just quicker but also entails less paperwork, allowing borrowers the convenience of gaining access to funds in the comfort of their own homes.

Why Individuals Opt for the Best Online Loan App

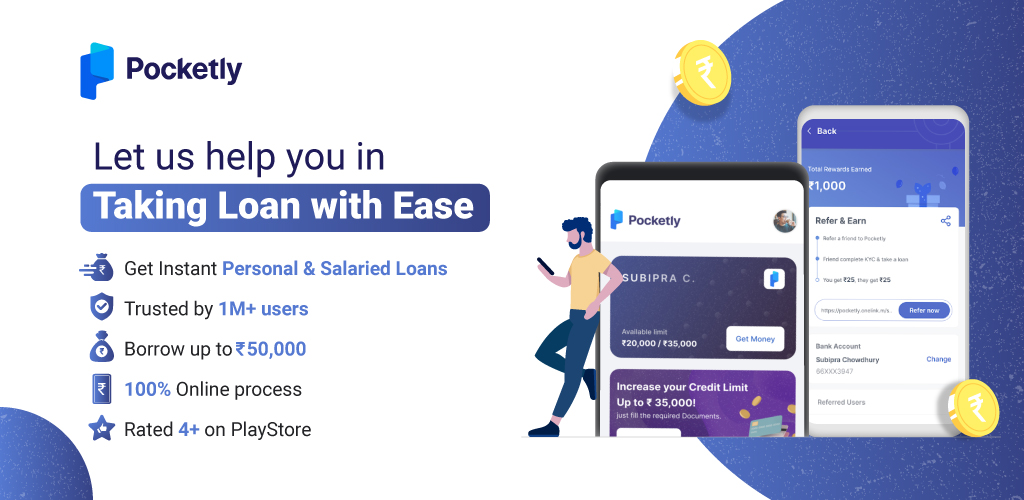

The second step after making up one’s mind to borrow online is selecting the best online loan app. A trustworthy app provides transparency, easy navigation, and swift processing. It gives you a transparent picture of the terms of the loan, repayment dates, and interest rates even before you go ahead with the application. Most reliable loan apps also come with easy repayment plans and are designed to meet various financial requirements; either a small one for regular expenditure or a big one for emergency commitments.

Advantages of Using a Cash Loan App

One of the most significant benefits of a cash loan app is the immediate availability of funds. In contrast to conventional approaches, the apps reduce lengthy waiting periods and make instant eligibility assessments. As soon as you qualify under the minimum requirements, the funds are usually transferred into your account within hours. Cash loan apps provide an easy option if you require quick cash without the hassle of a visit to the bank. They also provide hassle-free tracking of repayments, thus making the process stress-free.

Understanding Cash Loans: A Flexible Option

Cash loans are short-term loans usually provided without security or collateral, hence available to more people. Cash loans are a preferred alternative for individuals who encounter unforeseen financial problems because they do not have lengthy procedures.

What is a Creditline and How Does it Help

A Creditline is another intelligent borrowing option whereby you have access to a pre-approved credit facility that you can utilize whenever necessary. It is similar to a credit card, but you do not swipe it – instead, you transfer the money you need into your account.

The good news is that you only pay interest on what you utilize, not the full approved amount. This makes Creditlines suitable for those needing money flexibility without the weight of full debt loans repayment unless necessitated.

Speed Matters: Get Fast Approved Loans

Individuals tend to look for fast approved loans in case of an emergency. Online lending platforms have made it easy with instant approval systems and auto-verification checks. These loans are processed within a few hours, as long as your documents are accurate. Fast approvals help you avoid spending time waiting and being able to use the money immediately for your immediate requirement.

When You Need It Most: Get an Instant Loan

There is no comfort quite like the one of getting an instant loan when you’re in a difficult spot. Be it the end of the month or an unexpected occurrence, instant loans fill the gap between requirement and availability.

Final Thoughts:

Internet loans are not a luxury anymore; they’re an essential tool in today’s finance. With adequate research and prudent borrowing, you can make the best use of these instruments to fulfill your financial requirements effectively.