Understanding the intricate relationship between credit card bills and financial goals is paramount. Often viewed as a mundane monthly task, paying your credit card bill holds more significance than meets the eye. Let’s delve into the profound connection between managing credit card bills wisely and achieving your financial aspirations.

The Crucial Link

Your credit score is a representation of your creditworthiness and hinges heavily on how you handle your credit card bills. When you send money online to make timely payments, it contributes positively to your credit score, opening doors to favorable interest rates, better loan terms, and increased financial opportunities in the future. Failing to manage your credit card bills responsibly, however, can have a lasting impact on your creditworthiness, impeding your ability to achieve broader financial goals.

Interest Rates

Credit card bills aren’t just about the principal amount; they come with the added weight of interest rates. High-interest rates can lead to a snowball impact, making it challenging to pay off gathered obligations. By constantly overseeing your credit card bills, you not only dodge the burden of compounding intrigue but also free up assets that might be diverted towards your money-related objectives, whether it’s sparing for a domestic expense, or retirement.

Budgeting Discipline

Effectively handling credit card bills demands a keen eye for budgeting. Tracking expenses and adhering to a budget not only ensures timely bill payments but also fosters a sense of discipline. This financial discipline, cultivated through responsible credit card management, lays the groundwork for achieving broader financial goals. A well-structured budget, that aligns your spending with your priorities, propels you towards financial freedom.

Emergency Preparedness

Life is unpredictable, and unexpected expenses can disrupt even the most meticulous financial plans. Credit cards, when utilized wisely, can serve as a money-related security net during crises. By keeping up a sound credit card installment schedule, you upgrade your capacity to address unanticipated circumstances without jeopardizing your long-term money-related goals.

Debt Management

Excessive credit card debt, or any bill payment debt, like a water bill pay debt, is a common stumbling block on the path to financial success. Wisely managing your credit card bills involves not just making minimum payments, but actively working towards reducing outstanding balances. This commitment to debt management clears obstacles from your financial path, allowing you to allocate resources towards savings, investments, and other strategic goals.

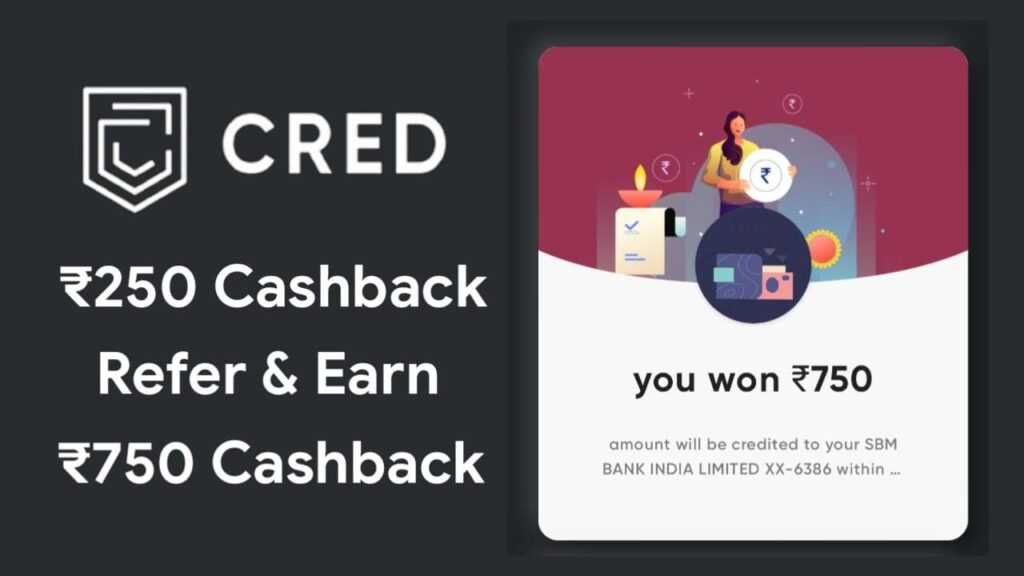

Rewards and Incentives

By leveraging reward programs and other incentives responsibly, you can align your credit card usage with your financial goals. Whether it’s earning travel points for a dream vacation or receiving cash back for everyday purchases, strategic credit card management can maximize financial gains, adding a valuable dimension to your overall financial strategy.

Long-Term Financial Planning

The key takeaway is to view credit cards as tools for financial empowerment rather than hurdles to overcome. When wielded wisely, credit cards can amplify your financial capabilities, offering convenience, security, and additional benefits. Integrating credit card management into your long-term financial plan ensures that you navigate the financial landscape with foresight, positioning yourself for success.

Conclusion:

The connection between credit card bills and financial goals is profound and multifaceted. By recognizing the impact of credit card management on credit scores, interest rates, budgeting discipline, emergency preparedness, debt management and timely bill payments, like a water bill payment, you can harness the power of credit cards to propel yourself toward financial success. Approach credit card bills with intention, and watch as they become stepping stones, rather than stumbling blocks, on your journey to achieving your financial aspirations.